pa inheritance tax family exemption

House Bill 465 modified 72 Pa. Beginning July 1 2013 the transfer at death of certain family owned business interests are exempt from the Pennsylvania inheritance tax.

Pennsylvania Inheritance Tax Everything You Need To Know Klenk Law

45 percent on transfers to direct.

. The most important exemption is for property that is owned jointly by a husband and wife. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate. 9111 titled Transfers.

How many inheritance tax exemptions are available pursuant to Act 85 of 2012. The rates for Pennsylvania inheritance tax are as follows. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries. Act 52 adds Section 2111t to the Pennsylvania Tax Reform Code to exempt the following transfers at death from PA inheritance tax. Traditionally the Pennsylvania inheritance tax had a very.

The transfer of your family-owned business to your family members may not be subject to any PA Inheritance Tax if it meets certain requirements. The Pennsylvania Legislature passed House Bill 465 which was signed into law by Governor Corbett on July 9 2013. Therefore if you and your spouse own all of your property jointly upon death of the first spouse.

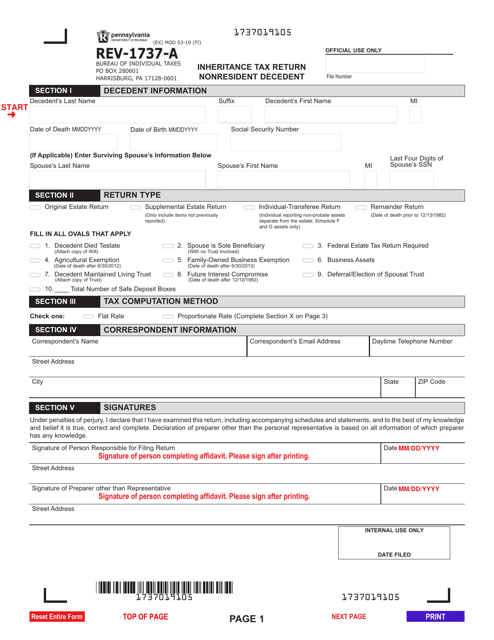

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. However if your business. REV-1197 -- Schedule AU.

Crew Estates and Trusts Wills and Estate Plans March 15 2022. Pennsylvania Inheritance Tax Law Has New Exemption For Small Family Businesses By Shannon L. The family exemption is allowed against assets passed with or without a will.

The family exemption is 3500. 1 A transfer of a qualified family-owned. Pennsylvania Inheritance Tax is.

REV-714 -- Register of Wills Monthly Report. The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or. REV-720 -- Inheritance Tax General Information.

Effective July 1 2013 a small business exemption from inheritance tax is available for a transfer of a qualified family-owned business interest to one or more qualified. Pennsylvania Inheritance Tax Safe Deposit Boxes. To understand the significance of this most recent change its helpful to review the history of Pennsylvanias inheritance tax law.

As the family exemption under the Probate Estates and Fiduciaries Code. Act 85 of 2012 created two exemptions the business of agriculture 72 PS. To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily.

Who is entitled to claim the family exemption for inheritance tax. The probate process might require a tax return filed but the end. The rates for Pennsylvania inheritance.

Surviving spouses charities and transfers to the government are exempt from the Pennsylvania Inheritance Tax. The family exemption is generally payable from the probate estate and in certain. Under the qualified family-owned business exemption 72 PS.

Use this schedule to report a business interest for which you claim an exemption from inheritance tax. What is the inheritance tax rate in Pennsylvania.

Pennsylvania Tax Exemption For Family Owned Business

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Pa Tax Exemption For Family Owned Businesses Supinka Supinka Pc

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Family Business Succession Planning Opportunities The Cpa Journal

Register Of Wills Clerk Of Orphans Court Division Delaware County Pennsylvania

Pa Rev 1500 2019 2022 Fill Out Tax Template Online Us Legal Forms

Pa Tax Exemption For Family Owned Businesses Supinka Supinka Pc

Why Retire In Pa Best Place To Retire Cornwall Manor

What Is The Difference Between Estate And Inheritance Tax In Pa

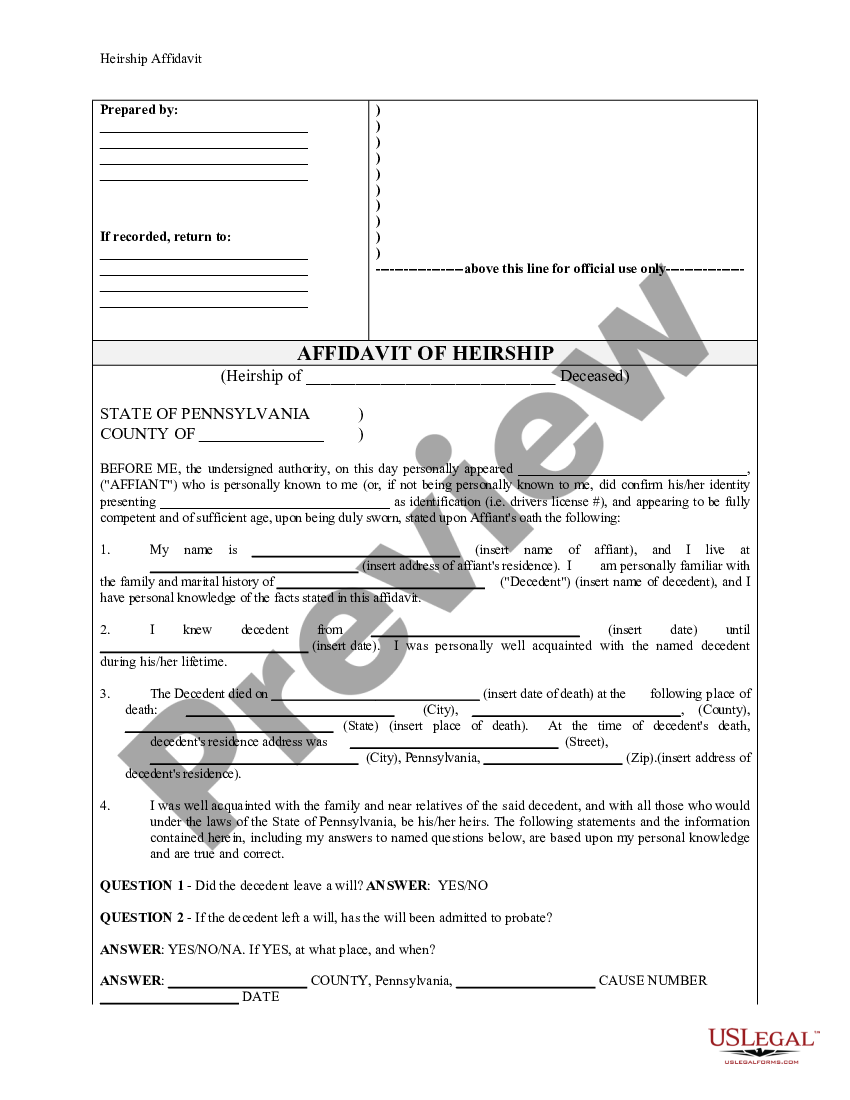

Pennsylvania Heirship Affidavit Descent Affidavit Of Heirship Pennsylvania Us Legal Forms

Pennsylvania Tax Exemption For Family Owned Business

New Change To Pennsylvania Inheritance Tax Law Takes Effect

Do Heirs Pay Inheritance Tax On Iras In Pennsylvania

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Pennsylvania Inheritance Tax And Other Factors When Inheriting A Home

Estate And Inheritance Taxes Around The World Tax Foundation

Do I Pay Pa Inheritance Tax If My Relative Lives Out Of State