home equity loan texas law

The 2017 amendments authorized by Senate Joint Resolution 60 become effective for home equity loans made on or after Jan. Youll need more than 20 percent equity in your home to benefit from a cash-out refinance loan in Texas.

6 Best Home Equity Loans Of 2022 Money Money

The constitution provides that.

. The Texas Constitution has protected homesteads from forced sale for 158 years. Section 50a6 article xvi of the texas constitution allows certain loans to be secured against the equity in your home. 3 an owelty of partition.

A new administrative rule clarifies what it means to hold a real estate closing for a home equity loan at the offices of a lender an attorney or a title company in compliance with the Texas Constitution. Texas law does not permit more than one home equity loan to be issued for the same house at the same time. 4 the refinance of a lien including tax liens.

Constitutional Requirements for a Texas Home Equity Loan 1 The home equity loan is voluntary applicant is not required to obtain a Home Equity loan and the Home Equity lien is created under a written agreement with the consent of each owner and each owners spouse 2 The total debt encumbrances on the homestead including the HE loan cannot exceed 80 of. By Texas law the maximum amount you can borrow with any Home Equity Loan or a Home Equity Line of Credit is 80 of your homes appraised value. Upside Down Loans Refinancing Upside Down Loan Upside Down Loan Visit our site and try out our refinance calculator and you will see how much you could lower your monthly payments on your mortgage loan.

Some Texas laws regarding home equity loan procurement include. The constitutional provisions permitted loans for the purposes of 1 purchase money. The bankruptcy court argued that because there was an pre-existing home equity loan on the property the second home equity loan was in fact not really a home equity.

And 5 home improvements. Home Equity Loans in Texas Frost Bank. That means if you already have a 40000 mortgage against a home worth 80000 the most you can borrow is 24000.

If you do not repay the loan or if you fail to meet the terms of the loan the lender may foreclose and sell your home. Such loans are commonly known as equity loans. Texas Amends Home Equity Lending Provisions.

Texas Home Equity loans are limited to 80 of the appraised value of the house less any existing loans against the house mortgage andor home improvement. It made changes to Section 50 a of Article 16 of the Texas Constitution and became effective January 1 2018. 7 2017 Texas voters approved the eighth series of amendments to the Texas constitutional provisions permitting loans secured by homestead equity.

By Texas law the maximum amount you can borrow with any Home Equity Loan or a Home Equity Line of Credit is 80 of your homes appraised value. If you have an equity loan with an outstanding balance you must pay off the entire amount or refinance it into a new home equity loan. Key changes to the law include.

On November 7 2017 Texans passed Texas Proposition 2 also known as SJR 60 or the Home Equity Loan Amendment 2017. One year one loan. The Finance Commission of Texas and the Texas Credit Union Commission collectively the Commissions recently adopted amendments to the home equity lending regulations found in Title 7 Chapter 153 of the Texas Administration Code Chapter 153.

Section 50a6H of Article XVI of the Texas Constitution prohibits a home equity loan from being secured by any additional real or personal property other than the borrowers homestead. From the day you apply and proper disclosures are issued the note may not be signed until 12 days later. Texas has a 12-day cooling-off period.

In a recent Texas bankruptcy case the court rejected the assertion of a creditor that it had a home equity loan that should be secured and nondischargeable. With the complexity of Texas Mortgage laws. Texas home equity lending laws can be directed to the Office of Consumer Credit Commissioner OCCC which regulates the credit industry in Texas.

All loans are subject to credit approval and Credit Union of Texas lending policies. Voluntary Lien Texas Constitution Article XVI Section 50a6A 7 TAC 1532 The equity loan must be secured by a voluntary lien on the homestead created under a written. Home Equity Loan Laws in Texas.

A Look Inside Texas New Home Equity Loan Law. APR Annual Percentage Rate. A sample loan payment for a fixed equity loan based on 75000 at 300 APR for 15 years is 51794.

Regulatory Commentary on Equity Lending Procedures October 7 1998 Page 1. Under Texas state law the maximum amount of a home equity loan cant be more than 80 percent. Other restrictions may apply.

You may have only one Home Equity Loan or Line of Credit secured by the same property at any one time. What are Texass home equity loan requirements. Borrowers cant owe more than 80 percent of the market value of their home on their mortgage and home equity loans combined.

Thats because youll have to leave at. Summary of Applicable Texas Law. Note Chapter 153 contains the Commissions.

Restrictions on mortgage debt. This applies no matter how much equity your house possesses. Such property is commonly referred to as prohibited additional collateral In our September 2021 memo we addressed how Texas prohibition on additional collateral prevents.

Home Equity Line Of Credit Heloc Home Loans U S Bank

What Is A Home Equity Loan Money

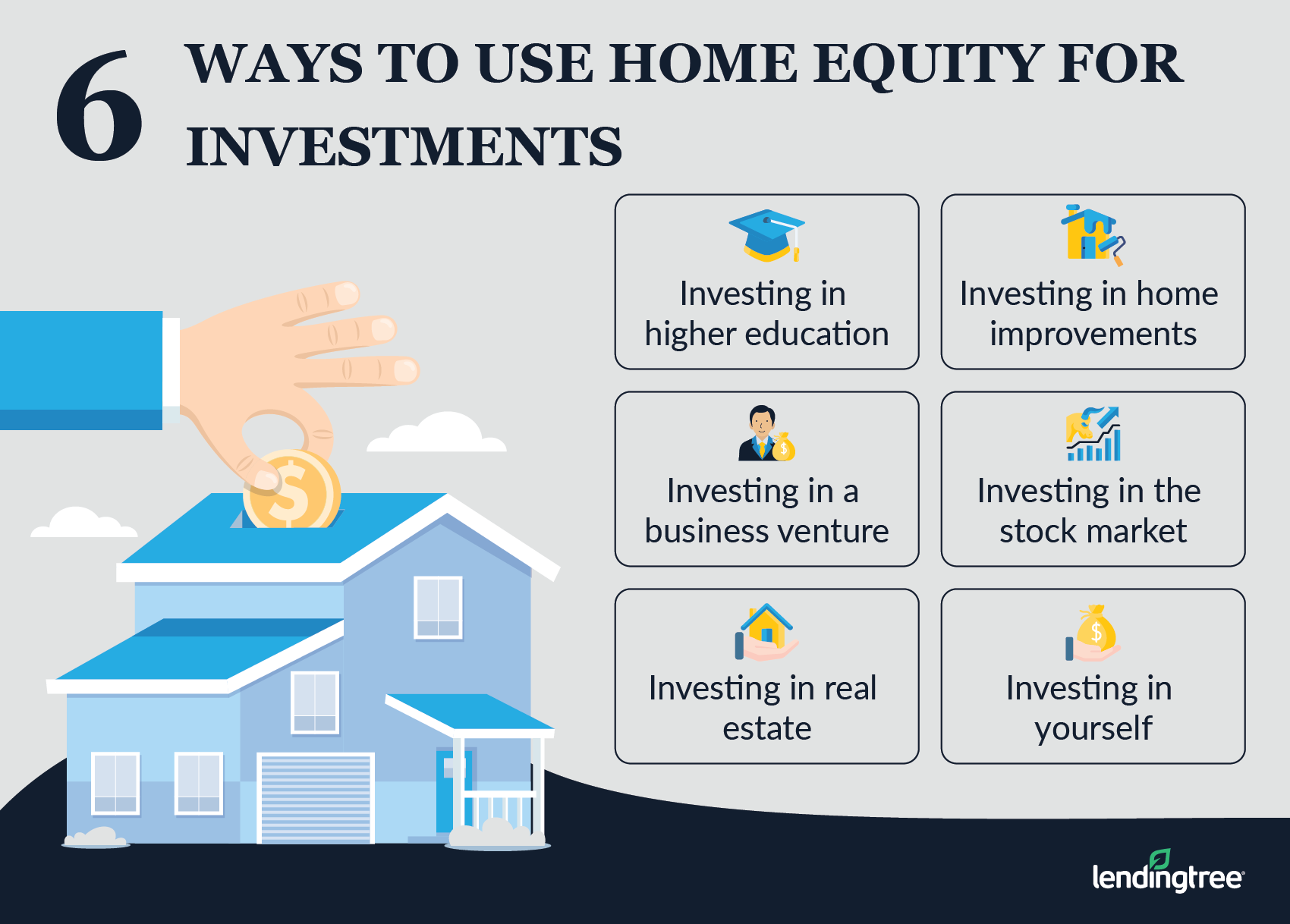

Can You Use Home Equity To Invest Lendingtree

Best Home Equity Loan Lenders Of 2022 Credible

How Does A Home Equity Loan Work In Texas

Navy Army Mortgage Loans Mortgage Loans Navy Federal Credit Union Loans Today

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

Interest Only Heloc Explained Nextadvisor With Time

Understanding The Challenges Of Financing A Vacation Home

Kentucky Va Mortgage Loan Information Va Mortgage Loans Mortgage Lenders Mortgage Loans

How Does A Home Equity Loan Work In Texas

Travel Inn Hotel Https Www Topgoogle Com Listing Travel Inn Hotel Located Just Three Blocks From The Jacob K Home Equity Home Equity Loan Business Notes

Orlando Home Mortgage Modification Attorneys Loan Modification Mortgage Interest Home Mortgage

Refinancing A Home Equity Loan What You Need To Know Credible

Best Home Equity Loan Lenders Of 2022 Credible

Saving To Buy A Home In Texas Texaslending Com

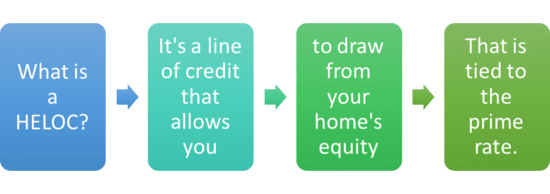

How A Heloc Works Tap Your Home Equity For Cash

If You Want To Renovate Your Home But Financial Problem Stand In Between Don T Worry At All Get Home Refinancing N Home Mortgage Home Equity Loan Home Buying

What Is Bankruptcy Bankruptcy Personal Finance Paying Student Loans